In general, families are eligible for financial assistance if they meet the state’s low income guidelines and need child care to work, look for work, or attend employment training. You are guaranteed child care if you are on Temporary Assistance and need child care in order to meet any work participation requirements. You are also guaranteed assistance in paying for child care for one year after leaving Temporary Assistance if you left Temporary Assistance for a job and need child care to go to work. Your County Department of Social Services (in New York City, the Human Resources Administration and the Administration for Children’s Services) determines family eligibility based on income, reasons for needing day care, and your child’s age and individual needs. In most cases, families receiving a child care subsidy can choose any legal child care provider.

If you are interested in finding out if you are eligible for a child care subsidy, or if you would like to apply for a subsidy for your child, contact your local Department of Social Services. If you want general information about child care subsidies, your local Child Care Resource and Referral Agency (CCRR) can also help you.

1091 Development Court

Kingston, NY 12401

Phone: 845-334-5489

Child Care Subsidy Program | Ulster County (ulstercountyny.gov)

25 Railroad Avenue

P.O. Box 458

Hudson, NY 12534

Phone: 518-828-9411

Columbia County Child Care Assistance Program

411 Main Street

P.O. Box 528

Catskill, NY 12414

Phone: 518-719-3700

Toll Free Phone: 877-794-9268

Services Information | Greene Government

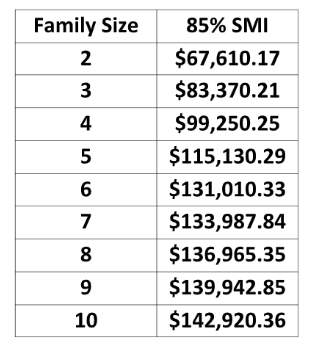

EFFECTIVE October 1, 2023

For other possible financial assistance programs contact (not including child care assistance):

Family of Woodstock, Inc. • https://www.familyofwoodstockinc.org

Hudson Valley 2-1-1 • https://www.hudson211.org/cms

Catholic Charities of Ulster County • (845) 340-9170

Ulster County Community Action Committee, Inc. • (845) 338-8750

Ulster County Department of Social Services • (845)334-5000

Kingston and Ulster Salvation Army • (845) 331-1803

Columbia Opportunities • (518) 828-4611

Catholic Charities of Columbia and Greene Counties • (518) 943-1462

Salvation Army of Columbia County • (518) 828-0420

Cairo Food Pantry • (518) 622-0038

Community Action of Greene County, Inc. • (518) 943-9205